Understanding the Economic Landscape: A Look Back at the Panic of 1896

The Question on Everyone’s Mind

Have you ever pondered why the U.S. economy seemed robust in the late 1890s, especially when the government itself was on the brink of financial collapse? This intriguing question was recently posed to financial expert Martin Armstrong, who provided illuminating insights.

The Root of the Concern

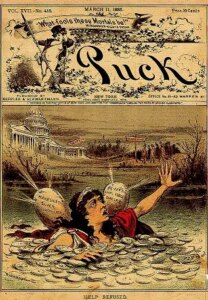

The query came from a reader named Chaz, who pointed out the paradox of a failing government that relied on tariffs for revenue. These tariffs generated a revenue stream, but America was facing instability, primarily due to the overvaluation of silver and its implications on the economy.

The Silver Democrats and Economic Overvaluation

Martin’s answer sheds light on an often-overlooked aspect of economic history. During the late 19th century, the Silver Democrats—politicians who aggressively promoted the use of silver—found themselves navigating murky waters. They were accused of taking bribes from silver miners, resulting in an overemphasis on silver’s value. This misalignment between silver and gold—gold being the standard for international settlements—created significant market distortions.

A Twist in Economic Orthodoxy

Interestingly, the insolvency the U.S. government faced during this period wasn’t primarily due to domestic debts. Instead, it stemmed from the discrepancy in the valuation of silver and the reality of gold’s standing in global finance. While the United States was rich in silver, the world traded in gold, sowing the seeds for financial unrest.

A Parallel to Today’s Economic Climate

Fast forward to today, and we find ourselves entrenched in a different sort of crisis—one defined by overwhelming national debt. While the Panic of 1896 was fueled by foreign exchange complications and political maneuvering, today’s dilemma involves rampant spending without accountability.

The parallels are stark, reminding us that historical patterns often seem to repeat. Just as the Democrats in 1896 sought to devalue their currency to stimulate the economy, contemporary policymakers grapple with similar temptations to inflate the money supply in hopes of reviving growth.

Lessons to Learn

So, what can we glean from the events of the Panic of 1896?

-

Value Alignment is Key: Financial systems function best when they align a currency’s value with its international standing—an imbalance leads to collapse.

-

Political Influence Matters: The motives driving political decisions can often destabilize economic frameworks. Awareness of such influences is critical for informed investing.

- Historical Awareness: Understanding past financial crises allows investors to anticipate potential threats that could arise in our current economic landscape.

Join the Conversation at Extreme Investor Network

At the Extreme Investor Network, we strive to provide you with strategies and insights that go beyond surface-level analysis. Our unique blend of historical context, economic theory, and real-world application equips you with the knowledge to make informed investment decisions. By exploring the nuances of economic history, we empower our community to recognize patterns and act strategically in today’s complex financial environment.

Conclusion

As we reflect on the circumstances surrounding the Panic of 1896, we invite you to consider the wider implications of political actions on economic health today. Join us at Extreme Investor Network for in-depth analyses and discussions that will help you navigate this evolving landscape with confidence.

Stay informed, stay invested!